Happy New Year, to one and all !

We never trust the start of January: short weeks and this year, lots of geopolitical and markets noise. This, along with a market with a cyclical playbook, and lessons from Central Asia. And can you hedge the AI risk?

Cycling along

So, I sense risk has gone up, as we start the year, despite markets suggesting otherwise. Results season will matter, as ever, and some of the hidden damage from political uncertainty and stress is likely to emerge in the numbers. Markets yearn for low inflation, but hate the resulting price deflation.

There is a long playbook, the economic cycle, which starts with low growth, high debt, and elevated interest rates, then as demand weakens from high rates, they start to fall, balance sheets stabilise, costs get cut. Mid-cycle the strong get stronger, buy backs rule, values rise, capital loosens. Then it matures, market excesses are apparent, prices rise still further, supply is short, inflation gets a grip, and all too soon we rollover into the repeat. Rates rise again. Demand falters.

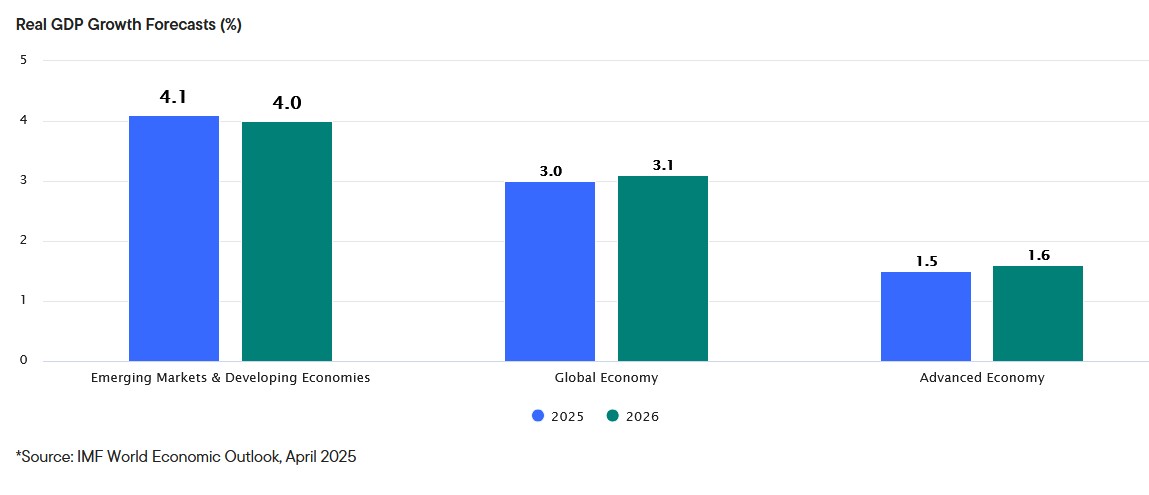

We are, on that reading, hitting mid-cycle, a time for value, emerging markets, capital intensive sectors. Tech may do well, but it is in a fight, as excess capital chases ever fewer resources, more is wasted, competition gets fiercer, speculative capital builds.

It fits with a political cycle too, debt concerns should weaken, with rate cuts, tax receipts will rise with economic activity. Of course, never quite in synch, with the old lags; but that’s the theory. We are not at the end, but perhaps the end of the beginning.

From: this source

Hence the hair trigger reaction to rate rises, or a failure to contain inflation, unimportant on their own, they would signal a turn in the cycle. Which equity markets hate.

Cooking pots – Central Asia and changes in Geopolitics

Over the break I enjoyed Svante E. Cornell’s recent collection of pieces, The Changing Geopolitics of Central Asia…., bite sized and rather more interesting than it sounds. Each player in the cauldron gets a chapter. There is the face-off between Russia and China, over ex-Soviet resource rich states. Then the same conflict between Europe and Russia. America barely features; Japan is more significant.

You can have a look at the book, here.

Biden dropped any Central Asia reference in his National Security Strategy, as did Obama, Trump One, reinstated it, but Trump Two does not bother. Over the whole thing the long goodbye and tragic collapse of Afghanistan looms large.

In this telling, China has a fairly defensive posture, worried about extremist Muslim factions, and keen to keep a lid on their own dissenters. Lots of spying, and looking for strategic trade routes, cheap gas, minerals. Exploiting Russian engagement elsewhere, and using debt to gain backdoor control over resources: significantly, no troops.

Russia by contrast suffers the delusion, all along the long southern border, that the ex-Soviet states remain in its sphere of influence. They want pliant customers, plenty of border intelligence, enough military involvement to see a coup coming (or to arrange it) and not to have the guns they sell pointed their way. This has to come with willing buyers of all they wish to sell, for hard currency, no quality concerns allowed.

After reading this, I understand the Baltic nerves better.

If America is unwilling, China not trusted, and Russia misbehaving, what of the other powers? Iran is in many ways the local Russian look-a-like, weaker, quieter but just as erratic. Turkey is also rebuilding a lost empire, although tellingly not one in Asia Minor; I was unaware of the nationalist faction that yearns for a state far to the East, and sees the Ottoman empire as an excrescence and a temporary exile.

Europe is playing a hand far closer to Japan, meanwhile. The authors see there too a deliberate easing off of overt pro-democracy requirements, a new realism in the years after 2011. Despite loud noises to the contrary.

This then is the source of the iceberg, whose jagged tip suddenly reared out of the Black Sea, on Europe’s doorstep.

In that world the Monroe doctrine of spheres of influence, of might is right, is common. Hong Kong, comes to mind, and Tibet, Crimea, South Ossetia, Northern Cyprus – all de facto seizures.

With those examples in mind, the State Department nerds could easily pitch a ‘might is right’ narrative to their elderly chief. Why have a vast military, and not use it?

A thin hedge

What then of those AI games?

Is there a trade beyond just a sell? Intellectual property monopolists, who will be destroyed if AI is half as good as it promises – include almost anything in media, or big data sets, from Taylor Swift to Bloomberg, via advertising and legal documents. The assumption had been that those previously well-moated empires are the new losers, think LSEG, WPP, UMG, RELX and so forth. In the process also rendering their debt loads less manageable.

Last year a trade seemed to be sell those, buy Nvidia and the like, with dramatic moves when victims became predators. For much of the year AI was going to kill Google, until suddenly the reverse; which became the new market wisdom, with their in-house AI. An exception, but also evidence of well-heeled adaptability.

If the AI race is just too expensive, then is the corollary, that the value destruction in those IP monopolists was overplayed?

Or is it, like Central Asia, more a plague on all their houses, get out of town, and find some real assets, with cash flow and real revenues, far away?

We are still in that rate cutting cycle, a lot of the announced fiscal stimulus is just coming through, yet geopolitics is not going away. Those vaunted deregulation gains are still struggling to offset tax rises and expanding protectionism.

So, I’m treading carefully on icy paths, and avoiding frozen ponds.