Chaos. Noise, with old systems falling apart. A deeper look at currencies and means of exchange, including bitcoin, and what is the UK Labour Party up to?

Why are stock markets so high, with the Dow breaking 50,000, from 25,000 in July 2020, if everything is indeed in flux?

FX Fables

We recently had a brilliant public talk at the LSE, given by a softly spoken Harvard man, who ambled off into the depths of currency theory, as gently as a lost puppy, used to coaxing American undergraduates in primary school whispers, and with beguiling blandness, to ponder interest rates over many centuries, which he believes are steadily falling; he sees the dollar as unnaturally high.

This is how I like my economics talks. No theories, plenty of facts. No British nonsense about the sources (there are few given) or comparability (likewise absent) to gently drift giant miasmic theories over a bubbling pool of fractured data.

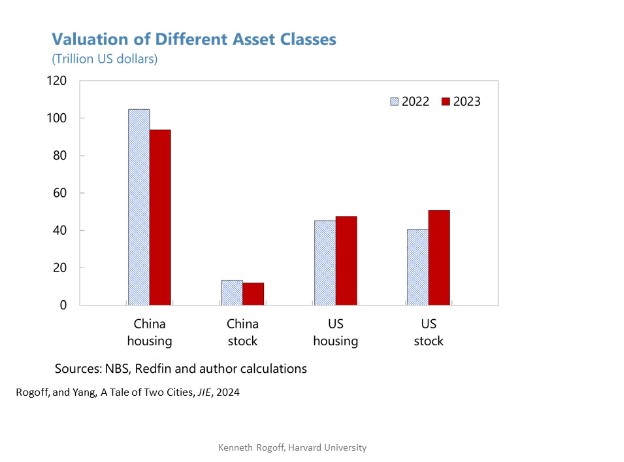

Skipping carelessly along, we had dollar crashes, satellite imaging of Chinese housing, and even terrorist financing in Lebanon. His conclusions (never predictions) included that China has over built (and borrowed) to a degree that they could take decades to recover from.

The data comes from satellites, confirming local authority records, not state sources, these show what has actually been built where, and then seeing how much housing China can consume, against even developed states; it still has way too much.

You wonder if their industrial policy is headed that way, excess savings and an ability to raise finance by demand suppression, is one form of economic evil.

Bitcoin has Real Value?

It does apparently, because in areas where the state has failed, it is the banking system. So, it represents real assets, debts and indeed food.

It then has as much (or little) value as any currency. He had a photo of a Hezbollah “bank” in Lebanon to prove it. The electronic traces show it offered just that, basic banking, offering dollars in a country with no money.

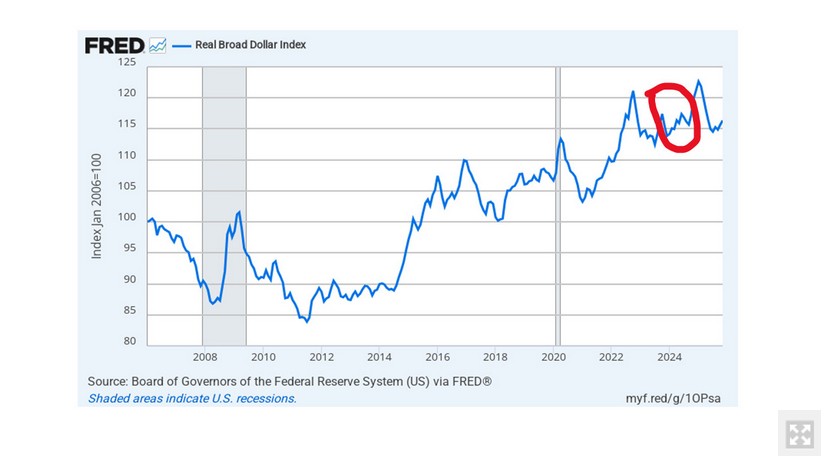

The real dollar could frankly do anything, based on his data. However, he sees increasing dollar strength this century, coupled with a decreasing US importance in the global economy. An odd mix, probably unstable. The fabled Economist’s Big Mac Index of purchasing power, says the same, suggesting the dollar remains overvalued in many places, especially Asia.

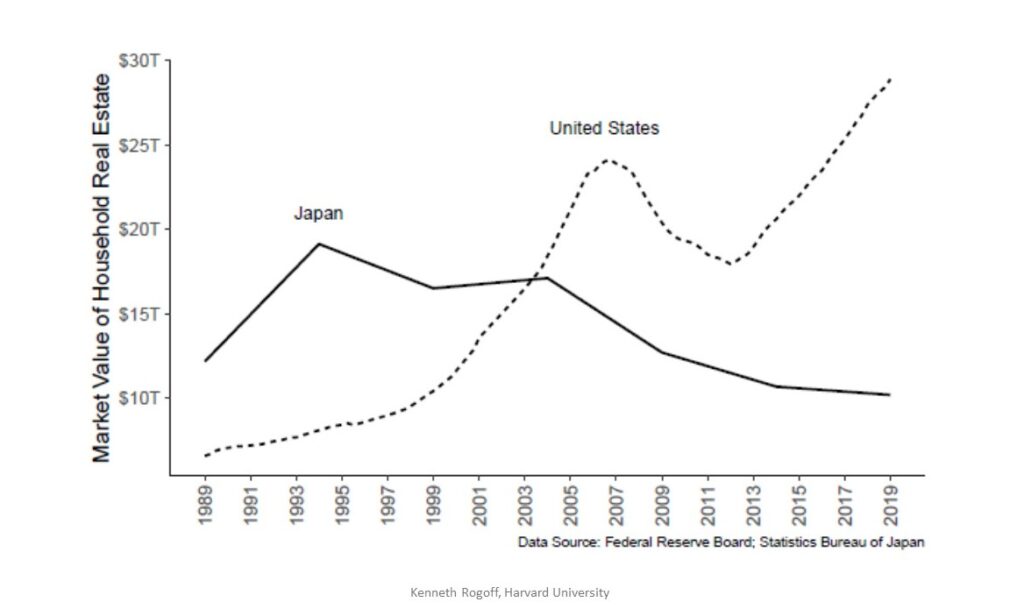

But it is less about a strong dollar than weak everything else, the failures are from other, non-dollar systems. Looking at US real estate values against Japan, in this graph, the latter peaked in 1993, and has drifted down since, while US Real Estate has soared away.

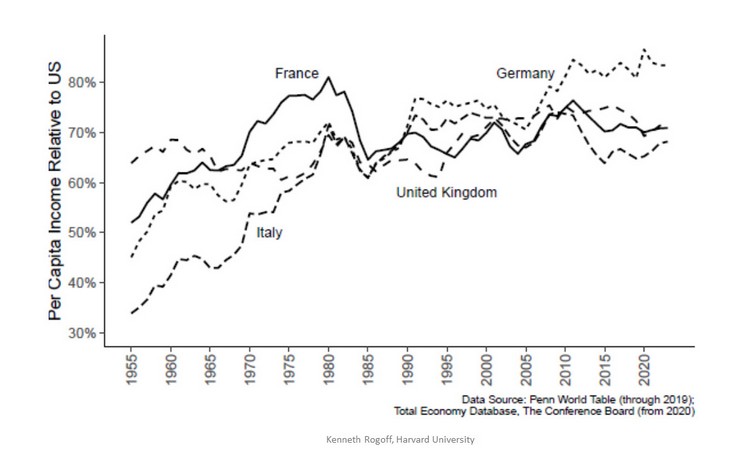

Or Europe, shown below, where the closest France has been to US levels of wealth, was in the early 1980’s, since when it has fallen back, while Germany has moved ahead, but the UK and Italy have stagnated. So whatever strength Europe had, has been dissipated, not consolidated.

Dissipated in empire building maybe? He pins it on the French over forcing the Greeks into the Euro.

That Europe having caught up with the US under the Marshall Plan, then stalled almost fifty years ago, again raises issue of excess consumption, compared to the continued investment (and low debt) in Germany.

Indeed, globally the world has got better at production, which is generating less wealth.

I do recommend the full one-hour talk – a YouTube link. Don’t be lulled by the gentle delivery of bombshells, nor expect conclusions, it is old fashioned economics, lots of conflicting data: its up to you to find the deductions.

The Mighty are Fallen

What is going on in bitcoin? Partly I see the arrival of hedge funds and institutional investors means the end of retail power, the new players expect to trade momentum, expect to liquidate fast when trends fail, that’s what they liked about bitcoin to start with. So, a 50% fall in a year is of no concern to them, they simply sold it.

Indeed, for governments bitcoin collapsing, bar a slight reduction in tax income from realised gains, matters little either. All in all, if it means illicit wealth and hot money has dropped in value, that’s good too. The price of an AK47 in Beirut, or heroin in Munich, in bitcoin, should have doubled, which is no bad thing.

What helps bitcoin stay up is the true believers. They have two problems; firstly all of a sudden something that looks like the same toy, is also racing ahead.

So, they face a quandary, do they buy bitcoin (falling) or silver (soaring)? Albeit the silver market may also not be that deep, and in that case true industrial buyers want the price a long way below this level.

Along with rumours of somehow AI or quantum computing undermining the whole thing. And in this area, rumours are potent.

But it is probably just bubbles chasing bubbles of hot money. Not a good thing. Although it is a bit harder to do, playing games with index funds just ahead of a Friday close, is nothing new either.

Kier Not Clear

Finally, Starmer, markets are really not saying he is in trouble, for all the noise. The FTSE has pulled back a tad, but is still well above 10,000. Likewise, sterling is pretty solid, if a real fear of a left-wing takeover existed, I would expect both to drop sharply.

There’s excitement and plotting, but little tangible is emerging.

It is, as we know, more about the poor job prospects of 200 back benchers, who hoped to be setting sail on a career, only to find the captain had no map, and the flimsy compromises they sat on would never survive a sea crossing.

But ditching the captain and buying new charts, whilst tempting, has no guarantees either.

We have moved quite sharply from Starmer ‘might not’ fight the next election, to at best a 50/50 chance of him doing so. But not in my mind worse than that, at least until the market says so.

Though look at the Tories: once you start dumping winning prime ministers and leaders – it never ends.