A look at the re-industrialisation idea, how it affects markets fleeing Tech, and Pershing Square Holdings.

Back on shore

Re-industrialisation is now pretty embedded in UK party policies, of all colours. It is implicit both in the Biden subsidy schemes, and then the Trump tariffs, and underlies the European Carbon Adjustment Border Mechanism. Most trade agreements now include quotas, especially on vehicles and metals, but its creeping in everywhere.

Sanctions are used extensively and protect energy producers, while tariffs and biosecurity protect farmers and soft commodities.

The theory is that Far Eastern labour undercuts the Western worker/voters, in an unfair way. As do capital allocation decisions by the Chinese state. Along with their manipulated low interest and exchange rate.

China also uses predatory pricing to create market share, and trade bans are widely used as a political tool, notably in rare earths, attacking EU states as well as its declared foes.

Against this sits the great, well proven power of open markets and innovation, to lift all mankind out of poverty, and endow the select few with great wealth and unrestrained consumption.

I have set out what re-industrialisation is against.

But what it is for? It is job creation in the areas created by the Industrial Revolution, now laid waste by global trade. From the Lancashire Cotton towns, through the Ruhr, out to Lower Saxony, round past Lille, over to Ohio and the Great Lakes Rust Belt, back to Pennsylvania down to the cold slag in the Welsh blast furnaces.

There’s a small amount of concern for these areas’ economies and a great deal of anxiety about their footloose voters. Listening to Trump rail against the Supreme Court’s quashing of certain tariffs, it was notably only those worker/voters he referenced.

What to protect

In part, post COVID, frictionless international trade and consumption tax loopholes have had a bad name.

We no longer want a great churning mass of multi-directional shipping just to save a few cents on an item. Instead, we add some friction, to reflect the true cost of free trade in externalities, social or environmental. Slow the beast down a bit.

Some of it is also to create, by subsidy, a second source, in vital minerals that cannot be left to the market. The Chinese wait for the second source to invest, then flood the market, once more, either in primary metals, or first stage sub-assemblies. The only way to stop that is direct ownership of production, by the taxpayer, along with minimum price guarantees. It is probably both: the price guarantee alone diversifies the supply base, but is all too easy to cut. Ownership forces the state into shared pain. We may dislike this, but sensibly managed, the benefits outweigh the costs.

Then in the middle, between slowing everything down a bit and strategic sourcing, sits the rather absurd, but politically adorable, business of white elephant husbandry. This prevails for goods which are widely available, effectively unrestricted in sources, not technically challenging, but photogenic. Steel, cars, guns.

Steel of the sort the UK can make, is ubiquitous. The Chinese have demonstrated that car prices are simply too high. Somewhere between production and sale we are no longer competitive. While to many investors the glorious thing about defence – the national security blanket – is it traps all the related jobs in the home country, and imports are easily stopped.

Will it work ?

At the end of all that, how effective is protectionism?

I expect it to be effective at creating employment, at first in stopping viable businesses closing, then moving capital investment back onshore, and over time creating new jobs. I am not sure these are in any great numbers, hundreds of thousands, not millions. That is still real, however.

But I seriously doubt the ability to save significant steel or car making jobs, without quite high impacts on consumer prices. Free trade operates as a permanent deflator.

Many of these measures to onshore are political, it is the worker/voter in large blocks, that they target. I struggle to see volume, complex manufacturing, with no selling price guarantee and heavy fixed investment, relying on a four-year reversing switch.

I do understand that it is unlikely that any future US (or EU) Government will actually reverse tariffs. Yet in the end much of the attempt (by all parties) to revive blue collar jobs is performative, they simply cost too much.

Markets catching on or bailing out.

I see the current enchantment with industrial stocks in both Europe and the US as a simple momentum trade.

What are they?

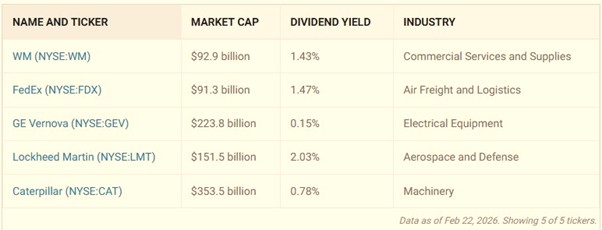

Well not always what you think, here is Motley Fool’s recent take.

From this article– see details and context, this is NOT our recommendation

Money has to come out of the overpriced mega caps, it is coming out of the AI trade, both because it is too expensive, too damaging to free cashflow, and out of software as it is too damaged by AI. (Although I am not sure that all of those three views can be true at once.)

Investors who are sold on the “running it hot” theory of fiscal stimulus into the Mid Terms, don’t want to be out of US equities. I see the same impulse in the current infatuation with energy stock. They have to buy something. I don’t.

Pershing Square

Which brings us to Pershing Square, London listed for the bulk of its assets, still, but fighting a big discount (so far with buy backs, but without making a bid; capacity for those is limited). It also faces lingering governance concerns about conflicts and fee levels.

Riding both their tactical genius in shorting the markets during a crisis, and US markets overall, they listed at below 150th in the FTSE 250 and are now heading towards 50th in the FTSE100. Not a bad move in a decade or so. Yet they now seem to be moving to increased Magnificent 7 exposure, out of fundamental conviction, just as the market starts to ditch those stocks.

Founder Bill Ackman is 59 but looked older at the AGM, with a lot of plates to keep spinning.

I still like the stock, but it is not a screaming buy any longer. But, nor do you see him in Industrials or Energy – he has strict number crunchers, not traders. So, an aspiring Buffett, but not the same.

Choices

It is not hammer and sickle stuff, just yet, this central planning, but nor is it enticing.

On-shoring needs to be far better than just beached industries.

While voters may like the sentiment, is that enough? It may help marginal seats both sides of the Atlantic, but are they sufficiently grateful?

What is the alternative, more welfare? More depopulation?

Always a fiscal transfer of some kind.