Sweet summer rain is falling, while some firms dance to remember, others to forget. We’re actually talking elephants this week – they can neither dance nor forget. A sidelong glance at tariffs (which really don’t matter, as we have said for ever) and an equity market frothing higher in often volatile summer trading.

First a closer look at a couple of lumbering monsters in the UK utility sector. Why care? Well, they are big capital spenders and with none of cyber security, zero carbon or AI possible unless they work better. They also sit in the FTSE 100, so index investors globally buy them, like it or not. Plus, a weird history of rhythmic cyclical capital allocation. You should care.

Faded Tartan

The two are the old Scottish Hydro, now Scottish and Southern Energy (SSE) and National Grid.

The typical cycle for privatised utilities seems to be – liberation, efficiency gains, global diversification, price controls, underinvestment, divestment, service failures. These raise capital as private sector firms, are owned by independent investors, but remain close to being government agencies. An awkward hybrid.

We start with SSE, with so much diversification it changed its name to reflect ownership of Southern Electricity, but is a Scottish company, headquartered in Perth, with all the downside risk of parochial governance. The Chair also chairs Diageo, and as a non-exec seems to have a pretty notional interest in the Company’s shares.

Both firms had a shake up after all the 2024 elections, both got told to sharpen focus and speed up delivery. Both had to ditch the idea of exporting UK wind expertise, writing off a big chunk on odd Southern European (SSE) and offshore US (NG) projects.

SSE also owns odds and ends, it spent a lot of time trying to diversify outside Scotland. It now roughly balances the two UK businesses, renewables and all types of transmission and distribution. The populist love of cheap energy is becoming a real investment threat.

Their business model is of heavy ‘essential’ often expansionary, cap ex, on which they get a guaranteed rate of return. More cap ex, more return. More return, higher consumer prices. A flawed model.

Global Power

National Grid’s diversification has gone international – it said ‘we just do power transmission’, meaning anywhere. It too got told to focus, and has now sold off its renewable energy arm, spread across several US States.

The UK government have already stripped it of the business of managing the UK actual national grid, believing civil servants will do a better job. It even boldly states “our presence in Luxembourg is to address a nationalisation risk which arose from a Labour Party proposal”.

Six of nine non-execs have US careers, five of nine hold shares via ADRs, so clearly remain US based. The US contingent include the Chair, plus an ex Federal Reserve Bank Governor, the chief legal officer for IBM and an ex-COO of Tiger Management (a hedge fund). A wide spread of competencies, and with deep roots inside the US renewables industry. Odd for a UK company.

Four non-execs have no shares at all, two others have invested well below their annual pay, all of them are of course drawing six figure sums. They have looked to Shell for their new CEO, while SSE is now chaired by a BP man. Grown up capital allocation is the new theme.

All that expertise seems not to have shielded them from a £496 million exceptional hit for cleaning up a single site in the US last year, or indeed a £303 million hit for piling in (and out of) US offshore wind, that went up in smoke with a flick of Trump’s pen.

System Operators Gone Missing

It is notable that the Boards are light on anyone who operates systems, heavy on deal makers and retired regulators. As for service failures, a bit of kit self-incinerating in 2021 cost some £92m, what this year’s Heathrow conflagration will cost is unclear. It will be a fair bit.

They expect UK power consumption to rise by almost 50% by 2035, and by 25% at the same date in their US operations. An increased load well beyond the capacity of dispersed renewables to provide to the grid; there are years of connection backlogs.

The US provides about 40% of profits, the UK about 60%, but the US takes over half the cap ex, which is running at twice the level of profits.

Both bad debts in the US consumer side and local property taxes are very high, at about half a billion and one billion respectively. Working in New York may mean high capital demand, but it also means high local tax and heavy disguised social subsidy.

Even that £496m single site clean-up, is ultimately recovered from the consumer in over-priced power – green energy fills pockets at the consumers’ expense.

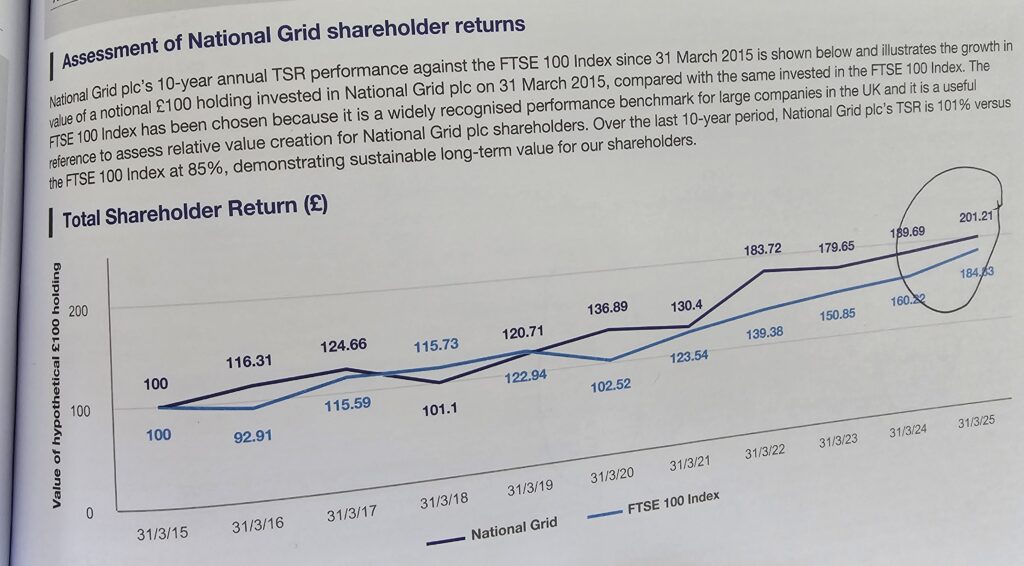

For all of the above, both companies have beaten the FTSE-100 over the last decade. Tellingly.

Graph is taken from Page 131 of the hard copy of the National Grid Annual Report and Accounts

Tax and Spend

I have little to add on tariffs, beyond repeating that the US Rust Belt voter is the ONLY target, where the key Congressional swing seats are, the rest is NOISE. That means CARS and METALS. So, the big car exporters to the US will provide the FLASH points.

However, most countries would love the chance to put high tariffs on US imports; they can see the tax yield Trump is achieving, without provoking inflation; so, several are talking deal, but really have no desire to strike one. States (or in the EU case) nations have very different agendas, but do expect the pro-tariff, pro-tax raising, protectionists, to be shy but influential.

Otherwise, fiscal fuel is pouring into markets, good for equities, bad for rate cuts.

Still Muddy

On a final point, several readers wondered if my ending active fund management, was an end of the Snipe. Not so, I remain involved in managing momentum strategies, and offshore private credit, which is where the demand is now.